AUD is under pressure due to its American counterpart growth. The support rests in 0.71580 with resistance at 0.72330 which the weekly pivot point at 0.72150 is located in between the lines. The EMA of 10 is moving with bullish bias and it is located below the EMA of 100 and the EMA of 200. The RSI is rising towards the 50 level, the MACD indicator is in the negative territory and the Stochastic is showing upward momentum. The ADX is not showing any clear signals. The chart seems bearish therefore sellers can target 0.71 area.

https://fxglory.com/audusd-analysis-for-29-12-2016/

Thursday, December 29, 2016

USDJPY analysis for 29.12.2016

USD is acting stronger than JPY due to the Japan economic data such as Industrial Production rate. The support rests at 116.560 with resistance at 117.020 which both lines are below the weekly pivot point at 117.360. The EMA of 10 is moving with bearish bias and it is located above the EMA of 200 and the EMA of 100. The RSI is moving in oversold area, the Stochastic is moving in low ranges and the MACD indicator is in neutral territory. The ADX is showing sell signal. Short positions are recommended targeting 115 area.

https://fxglory.com/usdjpy-analysis-for-29-12-2016/

https://fxglory.com/usdjpy-analysis-for-29-12-2016/

EURUSD analysis for 29.12.2016

USD was supported due to the positive economic reports in the US such as Fed’s decision to hike the rate and the new president’s attempt to help in economic growth. The support rests at 1.03820 with resistance at 1.04780 which the weekly pivot point at 1.04340 is locating in between the lines. The EMA of 10 is moving with bullish bias and it is below the EMA of 100 and 200. The RSI is rising above the 50 level, the Stochastic is showing upward momentum and the MACD indicator is in neutral territory. The ADX is showing buy signal. The chart seems bullish for now therefore long positions are recommended targeting the resistance area.

https://fxglory.com/eurusd-analysis-for-29-12-2016/

https://fxglory.com/eurusd-analysis-for-29-12-2016/

Wednesday, December 28, 2016

USDCAD analysis for 28.12.2016

USDCAD is chiefly under the influence of last week’s GDP and CPI. The pair is finding support at 1.35510 with resistance at 1.35850 which both lines are above the weekly pivot point at 1.34690. The EMA of 10 is moving with bullish bias and it is located above the EMA of 100 and above the EMA of 200. The RSI is moving in overbought area, the MACD indicator is in positive territory and the Stochastic is moving in high ranges, showing downward momentum. The ADX is showing a weak buy signal. Downward correction pattern will start soon targeting 1.347 area.

https://fxglory.com/usdcad-analysis-for-28-12-2016/

https://fxglory.com/usdcad-analysis-for-28-12-2016/

GBPUSD analysis for 28.12.2016

As the British markets were closed during the Christmas holiday on Tuesday, USD strengthened against GBP. The support rests at 1.22760 with resistance at 1.23020 which both lines are below the weekly pivot point at 1.23370. The EMA of 10 is moving horizontally but it is below the EMA of 100 and the EMA of 200. The RSI is moving below the 50 level, the Stochastic is showing upward momentum and the MACD indicator is in negative territory. The ADX is showing a weak buy signal. Short positions are recommended targeting 1.2100.

https://fxglory.com/gbpusd-analysis-for-28-12-2016/

https://fxglory.com/gbpusd-analysis-for-28-12-2016/

EURUSD analysis for 28.12.2016

USD is being supported due to the traders’ enthusiasm to trade before the new year holidays. The support rests at 1.04530 with resistance at 1.04980 which both lines are above the weekly pivot point at 1.04340. The EMA of 10 is moving with bullish bias and it is below the EMA of 100 and 200. The RSI is falling towards the 50 level, the Stochastic is moving in high ranges and the MACD indicator is in neutral territory. The ADX is showing buy signal. In terms of the resistance level breakout, buyers can target 1.0500; otherwise short positions are recommended targeting 1.035 area.

https://fxglory.com/eurusd-analysis-for-28-12-2016/

https://fxglory.com/eurusd-analysis-for-28-12-2016/

Tuesday, December 27, 2016

USDJPY analysis for 27.12.2016

The market was closed in Japan because of The Emperor’s Birthday ceremony on Friday. The support rests at 117.070 with resistance at 117.490 which the weekly pivot point at 117.090 is located in between the lines. The EMA of 10 is moving with bearish bias and it is located above the EMA of 200 and the EMA of 100. The RSI is falling below the 50 level, the Stochastic is moving in high ranges and the MACD indicator is in neutral territory. The ADX is showing buy signal. Buyers’ can target 118.5 area for their next destination.

https://fxglory.com/usdjpy-analysis-for-27-12-2016/

https://fxglory.com/usdjpy-analysis-for-27-12-2016/

EURUSD analysis for 27.12.2016

EUR was supported due to the Euroland positive data. The support rests at 1.04360 with resistance at 1.04640 which both lines are below the weekly pivot point at 1.04940. The EMA of 10 is moving horizontally and it is below the EMA of 100 and 200. The RSI is moving on the 50 level, the Stochastic is showing downward momentum and the MACD indicator is in neutral territory. The ADX is showing buy signal. The chart seems bearish for now, the sellers’ target will be 1.0400.

https://fxglory.com/eurusd-analysis-for-27-12-2016/

https://fxglory.com/eurusd-analysis-for-27-12-2016/

EURUSD analysis for 22.12.2016

There were no major events in Euro zone therefore EURUSD is chiefly under the influence of Existing Home Sales. The support rests at 1.04240 with resistance at 1.04500 which both lines are below the monthly pivot point at 1.08010. The EMA of 10 is moving with bullish bias and it is below the EMA of 100 and 200. The RSI is moving on the 50 level, the Stochastic is moving in high ranges while showing upward momentum and the MACD indicator is in neutral territory. The ADX is showing buy signal. Long positions are recommended targeting 1.0500 area.

https://fxglory.com/eurusd-analysis-for-22-12-2016/

https://fxglory.com/eurusd-analysis-for-22-12-2016/

USDJPY analysis for 22.12.2016

USDJPY is under the influence of Kuroda’s remark which weakened USD. The support rests at 117.450 with resistance at 117.770 which both lines are above the weekly pivot point at 117.240. The EMA of 10 is moving horizontally and it is located above the EMA of 200 and the EMA of 100. The RSI is moving on 50 area, the Stochastic is showing upward momentum and the MACD indicator is in positive territory. The ADX is not showing any clear signals. Long positions are recommended at the moment, targeting 119.00 area. However, the support level breakthrough will smooth the way for further decline targeting 116.00.

https://fxglory.com/usdjpy-analysis-for-22-12-2016/

https://fxglory.com/usdjpy-analysis-for-22-12-2016/

USDCAD analysis for 22.12.2016

While oil prices are leaving negative impact on USDCAD, this pair is also under the influence of Canadian CPI and retail sales data. The pair is finding support at 1.34130 with resistance at 1.34450 which both lines are above the weekly pivot point at 1.32890. The EMA of 10 is moving with bullish bias and it is located above the EMA of 100 and the EMA of 200. The RSI is moving in overbought area, the MACD indicator is in positive territory and the Stochastic is moving in high ranges, showing upward momentum. The ADX is showing buy signal. The chart will continue its trend with bullish tone targeting 1.3470.

https://fxglory.com/usdcad-analysis-for-22-12-2016/

https://fxglory.com/usdcad-analysis-for-22-12-2016/

Wednesday, December 21, 2016

NZDUSD analysis for 21.12.2016

While Yellen’s speech on Monday empowered USD, put pressure on NZD. The support rests in 0.69040 with resistance at 0.69560 which both lines are below the weekly pivot point at 0.70030. The EMA of 10 is moving with bearish bias and it is located below the EMA of 100 and the EMA of 200. The RSI is moving in oversold area, the MACD indicator is in negative territory and the Stochastic is moving horizontally in high ranges. The ADX is showing a weak sell signal. Short positions are recommended targeting 0.6800.

https://fxglory.com/nzdusd-analysis-for-21-12-2016/

https://fxglory.com/nzdusd-analysis-for-21-12-2016/

GBPUSD analysis for 21.12.2016

Despite the GBPUSD attempt to turn into bullish, it continued its downward trend. The support rests at 1.23550 with resistance at 1.23910 which both lines are below the weekly pivot point at 1.24780. The EMA of 10 is moving with bearish bias and it is below the EMA of 100 and the EMA of 200. The RSI is moving in oversold area, the Stochastic is showing upward momentum and the MACD indicator is in negative territory. The ADX is showing a weak sell signals. The support level breakthrough will smooth the way for further decline targeting 1.2200.

https://fxglory.com/gbpusd-analysis-for-21-12-2016/

https://fxglory.com/gbpusd-analysis-for-21-12-2016/

EURUSD analysis for 21.12.2016

USD was empowered due to the Yellen’s speech on Monday. The support rests at 1.03820 with resistance at 1.04280 which both lines are below the monthly pivot point at 1.08010. The EMA of 10 is moving with bearish bias and it is below the EMA of 100 and 200. The RSI is rising towards the 50 level, the Stochastic is moving in high ranges while showing upward momentum and the MACD indicator is in negative territory. The ADX is not showing any clear signals. Short positions are recommended targeting 1.030 area.

https://fxglory.com/eurusd-analysis-for-21-12-2016/

https://fxglory.com/eurusd-analysis-for-21-12-2016/

Tuesday, December 20, 2016

AUDUSD analysis for 20.12.2016

While AUD is waiting for Australian budget and AAA ratings, it is losing power. The support rests in 0.72320 with resistance at 0.72660 which both lines are below the weekly pivot point at 0.73360. The EMA of 10 is moving with bearish bias and it is located below the EMA of 100 and the EMA of 200. The RSI is moving in oversold area, the MACD indicator is in negative territory and the Stochastic is moving in low ranges. The ADX is showing strong buy signal. At the moment sellers can expect further decline to 0.7200 however after that, the chart will turn into bullish creating a good opportunity for buyers.

https://fxglory.com/audusd-analysis-for-20-12-2016/

https://fxglory.com/audusd-analysis-for-20-12-2016/

USDJPY analysis for 20.12.2016

JPY gained momentum due to the Export and Import data on Monday. The support rests at 116.560 with resistance at 118.600 which the weekly pivot point at 117.240 is located in between the lines. The EMA of 10 is moving with bullish bias and it is located above the EMA of 200 and the EMA of 100. The RSI is rising towards the overbought area, the Stochastic is showing upward momentum and the MACD indicator is in positive territory. The ADX is showing buy signal. Long positions are recommended targeting 119.00.

https://fxglory.com/usdjpy-analysis-for-20-12-2016/

https://fxglory.com/usdjpy-analysis-for-20-12-2016/

EURUSD analysis for 20.12.2016

EUR was supported due to the Business Climate report in Germany. The support rests at 1.03770 with resistance at 1.04270 which both lines are below the monthly pivot point at 1.08010. The EMA of 10 is moving with bearish bias and it is below the EMA of 100 and 200. The RSI is moving in oversold area, the Stochastic is moving in low ranges and it is showing downward momentum and the MACD indicator is in negative territory. The ADX is not showing any clear signals. Sellers can target 1.0350 for EURUSD’s next destination.

https://fxglory.com/eurusd-analysis-for-20-12-2016/

https://fxglory.com/eurusd-analysis-for-20-12-2016/

Monday, December 19, 2016

USDCAD analysis for 19.12.2016

USDCAD is chiefly under the influence of US housing which declined and the oil prices. The pair is finding support at 1.33090 with resistance at 1.33570 which both lines are above the weekly pivot point at 1.32890. The EMA of 10 is moving horizontally and it is located above the EMA of 100 and above the EMA of 200. The RSI is falling towards the 50 level, the MACD indicator is in positive territory and the Stochastic is moving in low ranges. The ADX is showing a weak buy signal. The pair is headed towards the support area targeting 1.3260 afterwards.

https://fxglory.com/usdcad-analysis-for-19-12-2016/

https://fxglory.com/usdcad-analysis-for-19-12-2016/

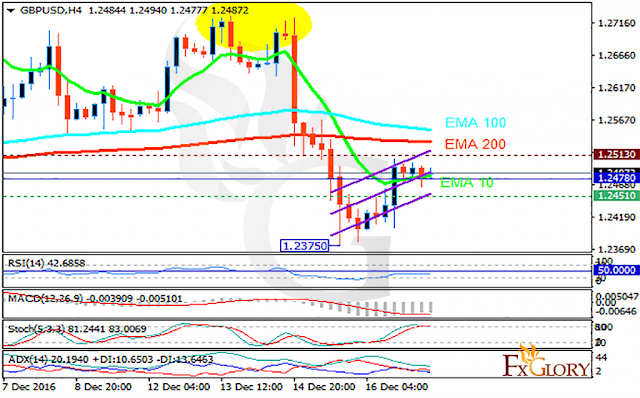

GBPUSD analysis for 19.12.2016

The BoE’s meeting last week did not leave any special impact on GBP therefore this currency is acting weak against USD. The support rests at 1.24510 with resistance at 1.25130 which the weekly pivot point at 1.24780 is located in between the lines. The EMA of 10 is moving horizontally and it is below the EMA of 100 and the EMA of 200. The RSI is moving below 50 area, the Stochastic is moving in high ranges and the MACD indicator is in negative territory. The ADX is showing buy signal. Short positions are recommended targeting 1.2400.

https://fxglory.com/gbpusd-analysis-for-19-12-2016/

https://fxglory.com/gbpusd-analysis-for-19-12-2016/

EURUSD analysis for 19.12.2016

EUR has been under the influence of Eurozone Trade Balance which decreased in October. The support rests at 1.04460 with resistance at 1.04760 which both lines are below the monthly pivot point at 1.08010. The EMA of 10 is moving with bearish bias and it is below the EMA of 100 and 200. The RSI is moving below the 50 level, the Stochastic is moving in high ranges while showing upward momentum and the MACD indicator is in negative territory. The ADX is showing buy signal. The chart seems bearish therefore 1.0400 will be sellers’ next target.

https://fxglory.com/eurusd-analysis-for-19-12-2016/

https://fxglory.com/eurusd-analysis-for-19-12-2016/

NZDUSD analysis for 16.12.2016

NZD is losing its power against its American counterpart due to the Fed’s rate hike. The support rests in 0.70110 with resistance at 0.70450 which both lines are below the weekly pivot point at 0.71480. The EMA of 10 is moving with bearish bias and it is located below the EMA of 100 and the EMA of 200. The RSI is moving in oversold area, the MACD indicator is in negative territory and the Stochastic is moving horizontally in low ranges. The ADX is showing sell signal. Short positions are recommended targeting 0.70 area.

https://fxglory.com/nzdusd-analysis-for-16-12-2016/

https://fxglory.com/nzdusd-analysis-for-16-12-2016/

USDJPY analysis for 16.12.2016

Finally after the Fed hiked its rates, USD is acting stronger against JPY. The support rests at 117.940 with resistance at 118.400 which both lines are above the weekly pivot point at 114.640. The EMA of 10 is moving with bullish bias and it is located above the EMA of 200 and the EMA of 100. The RSI is moving in overbought area, the Stochastic is showing downward momentum and the MACD indicator is in positive territory. The ADX is showing a weak buy signal. Long positions are recommended targeting 119 area.

https://fxglory.com/usdjpy-analysis-for-16-12-2016/

https://fxglory.com/usdjpy-analysis-for-16-12-2016/

EURUSD analysis for 16.12.2016

EUR was empowered due to the Eurozone Manufacturing PMI release. The support rests at 1.04010 with resistance at 1.04610 which both lines are below the weekly pivot point at 1.05710. The EMA of 10 is moving with bearish bias and it is below the EMA of 100 and 200. The RSI is moving in oversold area, the Stochastic is moving in low ranges while showing upward momentum and the MACD indicator is in negative territory. The ADX is not showing any clear signal. The pair is creating the recovery pattern heading towards the resistance zone therefore long positions would be recommended.

https://fxglory.com/eurusd-analysis-for-16-12-2016/

https://fxglory.com/eurusd-analysis-for-16-12-2016/

Thursday, December 15, 2016

EURUSD analysis for 15.12.2016

EURUSD is under the influence of Germany Manufacturing PMI from Markit for today. The support rests at 1.04740 with resistance at 1.05460 which both lines are below the weekly pivot point at 1.05710. The EMA of 10 is moving with bearish bias and it is below the EMA of 100 and 200. The RSI is moving in oversold area, the Stochastic is moving in low ranges and the MACD indicator is in negative territory. The ADX is showing a weak sell signal. As the pair is not falling lower, buyers’ next target would be 1.0500.

https://fxglory.com/eurusd-analysis-for-15-12-2016/

https://fxglory.com/eurusd-analysis-for-15-12-2016/

GBPUSD analysis for 15.12.2016

USD is losing power due to the U.S Retail Sales. At the moment GBPUSD is under the influence of BoE decision regarding the rate. The support rests at 1.25190 with resistance at 1.25660 which both lines are below the weekly pivot point at 1.26010. The EMA of 10 is moving with bearish bias but it is above the EMA of 100 and the EMA of 200. The RSI is rising towards 50 area, the Stochastic is moving in low ranges and the MACD indicator is in neutral territory. The ADX is not showing any clear signals. The chart seems bullish for now targeting 1.2770.

https://fxglory.com/gbpusd-analysis-for-15-12-2016/

https://fxglory.com/gbpusd-analysis-for-15-12-2016/

AUDUSD analysis for 15.12.2016

The Australian Consumer Confidence index has left a positive impact on AUD. The support rests in 0.74000 with resistance at 0.74360 which both lines are below the monthly pivot point at 0.74900. The EMA of 10 is moving with bearish bias and it is located below the EMA of 100 and the EMA of 200. The RSI is moving in oversold area, the MACD indicator is falling towards the negative territory and the Stochastic is showing downward momentum. The ADX is not showing any clear signals. The chart is forming the correction pattern therefore buyers can target 0.7550.

https://fxglory.com/audusd-analysis-for-15-12-2016/

https://fxglory.com/audusd-analysis-for-15-12-2016/

Wednesday, December 14, 2016

USDCAD analysis for 14.12.2016

USDCAD is chiefly under the influence of oil prices. The pair is finding support at 1.31070 with resistance at 1.31270 which both lines are below the weekly pivot point at 1.32050. The EMA of 10 is moving with bearish bias and it is located below the EMA of 100 and above the EMA of 200. The RSI is moving in oversold area, the MACD indicator is in negative territory and the Stochastic is showing downward momentum. The ADX is showing a weak sell signal. Short positions are recommended targeting 1.3070.

https://fxglory.com/usdcad-analysis-for-14-12-2016/

https://fxglory.com/usdcad-analysis-for-14-12-2016/

USDJPY analysis for 14.12.2016

While investors are waiting for the Fed’s decision regarding the rate hike, there has been no important economic reports in the US or Japan to influence USDJPY. The support rests at 114.890 with resistance at 115.430 which both lines are above the weekly pivot point at 114.640. The EMA of 10 is moving horizontally and it is located above the EMA of 200 and the EMA of 100. The RSI is moving on the 50 area, the Stochastic is showing downward momentum and the MACD indicator is in positive territory. The ADX is showing sell signal. After short term pullbacks, USDJPY will continue its upward trend targeting 116.00 area.

https://fxglory.com/usdjpy-analysis-for-14-12-2016/

https://fxglory.com/usdjpy-analysis-for-14-12-2016/

EURUSD analysis for 14.12.2016

EUR is appearing weak against USD due to the unchanged Economic Sentiment in Germany. The support rests at 1.06210 with resistance at 1.06630 which both lines are above the weekly pivot point at 1.05710. The EMA of 10 is moving with bullish bias and it is below the EMA of 100 and 200. The RSI is moving above the 50 level, the Stochastic is showing upward momentum and the MACD indicator is in neutral territory. The ADX is showing a buy signal. The resistance zone at 1.066 seems to be strong therefore after a short term rise, sellers’ next target can be 1.0550.

https://fxglory.com/eurusd-analysis-for-14-12-2016/

https://fxglory.com/eurusd-analysis-for-14-12-2016/

Tuesday, December 13, 2016

NZDUSD analysis for 13.12.2016

NZD is being supported since the new prime minister has been chosen. The support rests in 0.71720 with resistance at 0.72040 which both lines are above the weekly pivot point at 0.71480. The EMA of 10 is moving with bullish bias and it is located above the EMA of 100 and the EMA of 200. The RSI is falling towards the 50 level, the MACD indicator is in positive territory and the Stochastic is moving in high ranges but it is showing downward momentum. The ADX is showing buy signal. There is no clear signal to forecast the price direction however in terms of the price growth 0.7250 is buyers next target.

https://fxglory.com/nzdusd-analysis-for-13-12-2016/

https://fxglory.com/nzdusd-analysis-for-13-12-2016/

GBPUSD analysis for 13.12.2016

While USD is getting weak it is under the influence of Fed’s decision regarding the rate hike. The support rests at 1.26130 with resistance at 1.27630 which both lines are above the weekly pivot point at 1.26010. The EMA of 10 is moving with bullish bias and it is above the EMA of 100 and the EMA of 200. The RSI is moving above 50 area, the Stochastic is moving in high ranges while showing upward momentum and the MACD indicator is in positive territory. The ADX is showing buy signal. The resistance zone seems to be strong therefore short positions are recommended targeting 1.2500.

https://fxglory.com/gbpusd-analysis-for-13-12-2016/

https://fxglory.com/gbpusd-analysis-for-13-12-2016/

EURUSD analysis for 13.12.2016

While EUR is being empowered, USD is getting weak. The support rests at 1.05940 with resistance at 1.06840 which both lines are above the weekly pivot point at 1.05710. The EMA of 10 is moving with bullish bias and it is below the EMA of 100 and 200. The RSI is moving on the 50 level, the Stochastic is moving in high ranges and the MACD indicator is in negative territory. The ADX is showing a weak buy signal. Despite the pairs attempt to rise, short positions are recommended targeting 1.050 area.

https://fxglory.com/eurusd-analysis-for-13-12-2016/

https://fxglory.com/eurusd-analysis-for-13-12-2016/

Monday, December 12, 2016

AUDUSD analysis for 12.12.2016

AUDUSD is chiefly under the influence of Australian and Chinese PMI. The support rests in 0.74370 with resistance at 0.74650 which both lines are above the monthly pivot point at 0.74900. The EMA of 10 is moving with bearish bias and it is located below the EMA of 100 and the EMA of 200. The RSI is moving on the 50 area, the MACD indicator is moving in positive territory and the Stochastic is showing upward momentum. The ADX is showing buy signal. Long positions are recommended for short term traders targeting 0.7500 then sellers can wait for price decline.

https://fxglory.com/audusd-analysis-for-12-12-2016/

https://fxglory.com/audusd-analysis-for-12-12-2016/

USDJPY analysis for 12.12.2016

USD is acting stronger against the JPY as the result of the US treasury yields. The support rests at 114.850 with resistance at 116.140 which both lines are above the weekly pivot point at 114.640. The EMA of 10 is moving with bullish bias and it is located above the EMA of 200 and the EMA of 100. The RSI is moving in overbought area, the Stochastic is moving is high ranges and the MACD indicator is in positive territory. The ADX is showing buy signal. Long positions are recommended targeting 117.00.

https://fxglory.com/usdjpy-analysis-for-12-12-2016/

https://fxglory.com/usdjpy-analysis-for-12-12-2016/

EURUSD analysis for 12.12.2016

USD was empowered due to the ECB decision. The support rests at 1.05320 with resistance at 1.05860 which both lines are below the monthly pivot point at 1.08010. The EMA of 10 is moving with bearish bias and it has crossed the EMA of 100 and now it is below the EMA of 100 and 200. The RSI is moving below the 50 level, the Stochastic is showing upward momentum and the MACD indicator is in negative territory. The ADX is not showing any clear signals. The chart is going bullish at the moment targeting 1.0613.

https://fxglory.com/eurusd-analysis-for-12-12-2016/

https://fxglory.com/eurusd-analysis-for-12-12-2016/

Thursday, December 8, 2016

NZDUSD analysis for 08.12.2016

NZD lost its power due to the dairy prices growth. The support rests in 0.71840 with resistance at 0.72300 which both lines are above the weekly pivot point at 0.71040. The EMA of 10 is moving with bullish bias and it is located above the EMA of 100 and the EMA of 200. The RSI is growing towards the overbought area, the MACD indicator is in positive territory and the Stochastic is moving in high ranges. The ADX is showing buy signal. Long positions are recommended targeting 0.7250.

https://fxglory.com/nzdusd-analysis-for-08-12-2016/

https://fxglory.com/nzdusd-analysis-for-08-12-2016/

GBPUSD analysis for 08.12.2016

GBP is acting weak against USD due to the Manufacturing and Industrial production reports. The support rests at 1.26250 with resistance at 1.26670 which the weekly pivot point at 1.26390 is located in between the lines. The EMA of 10 is moving horizontally and it is above the EMA of 100 and the EMA of 200. The RSI is moving on 50 area, the Stochastic is moving in high ranges while showing upward momentum and the MACD indicator is in positive territory. The ADX is not showing any clear signals. The chart seems bearish for now targeting 1.2500 area.

https://fxglory.com/gbpusd-analysis-for-08-12-2016/

https://fxglory.com/gbpusd-analysis-for-08-12-2016/

EURUSD analysis for 08.12.2016

There were no important economic reports yesterday to influence EURUSD. The support rests at 1.07510 with resistance at 1.07950 which both lines are above the weekly pivot point at 1.06480. The EMA of 10 is moving with bullish bias and it has crossed the EMA of 100 but it is below the EMA of 200. The RSI is moving above the 50 level, the Stochastic is moving in high ranges and the MACD indicator is in positive territory. The ADX is showing a buy signal. Long positions are recommended targeting 1.0800 area.

https://fxglory.com/eurusd-analysis-for-08-12-2016/

https://fxglory.com/eurusd-analysis-for-08-12-2016/

Wednesday, December 7, 2016

AUDUSD analysis for 07.12.2016

AUD is getting weak due to the RBA decision to leave the rate unchanged. The support rests in 0.74160 with resistance at 0.74480 which the weekly pivot point at 0.74420 is located in between the lines. The EMA of 10 is moving with bearish bias and it is located below the EMA of 100 and the EMA of 200. The RSI is moving on the 50 area, the MACD indicator is moving in neutral zone and the Stochastic is showing downward momentum. The ADX is showing sell signal. Considering the weak AUD, bullish movement is mostly probable therefore buyers can target 0.7550.

https://fxglory.com/audusd-analysis-for-07-12-2016/

https://fxglory.com/audusd-analysis-for-07-12-2016/

USDJPY analysis for 07.12.2016

Since there were no important economic reports in Japan, USDJPY is chiefly under the influence of the US economic reports such as: trade Balance and Factory Orders. The support rests at 113.830 with resistance at 114.530 which both lines are above the weekly pivot point at 113.010. The EMA of 10 is moving with bullish bias and it is located above the EMA of 200 and the EMA of 100. The RSI is moving above the 50 level, the Stochastic is showing upward momentum and the MACD indicator is in positive territory. The ADX is showing buy signal. Long positions are recommended targeting 115.00.

https://fxglory.com/usdjpy-analysis-for-07-12-2016/

https://fxglory.com/usdjpy-analysis-for-07-12-2016/

EURUSD analysis for 07.12.2016

While EUR is being supported by the positive GDP in Eurozone and Factory Orders in Germany, it is also under the influence of the recent changes in Italy. The support rests at 1.07110 with resistance at 1.07270 which both lines are above the weekly pivot point at 1.06480. The EMA of 10 is moving horizontally and it has crossed the EMA of 100 but it is below the EMA of 200. The RSI is moving above the 50 level, the Stochastic is moving in low ranges and the MACD indicator is in positive territory. The ADX is showing a weak buy signal. The chart seems bearish for now targeting 1.0700.

https://fxglory.com/eurusd-analysis-for-07-12-2016/

https://fxglory.com/eurusd-analysis-for-07-12-2016/

Tuesday, December 6, 2016

AUDUSD analysis for 06.12.2016

AUD gained momentum due to the commodity prices and upbeat Services PMI in China. The support rests in 0.74320 with resistance at 0.74720 which the weekly pivot point at 0.74420 is located in between the lines. The EMA of 10 is moving with bullish bias and it is located below the EMA of 100 and the EMA of 200. The RSI is moving on the 50 area, the MACD indicator is moving in neutral zone and the Stochastic is showing downward momentum. The ADX is not showing any clear signals. Short positions are recommended targeting 0.7400 area.

https://fxglory.com/audusd-analysis-for-06-12-2016/

https://fxglory.com/audusd-analysis-for-06-12-2016/

GBPUSD analysis for 06.12.2016

GBP is acting stronger against USD due to the UK’s upbeat Services PMI from Markit. The support rests at 1.27240 with resistance at 1.27580 which both lines are above the weekly pivot point at 1.26390. The EMA of 10 is moving with bullish bias along the ascendant channel and it is above the EMA of 100 and the EMA of 200. The RSI is moving in overbought area, the Stochastic is moving in high ranges while showing upward momentum and the MACD indicator is in positive territory. The ADX is showing buy signal. Long positions are recommended targeting 1.2800 area.

https://fxglory.com/gbpusd-analysis-for-06-12-2016/

https://fxglory.com/gbpusd-analysis-for-06-12-2016/

EURUSD analysis for 06.12.2016

Today EURUSD is chiefly under the influence of the Italian referendum which put EUR under pressure. The support rests at 1.07380 with resistance at 1.07780 which both lines are below the weekly pivot point at 1.06480. The EMA of 10 is moving with bullish bias and it has crossed the EMA of 100 but it is below the EMA of 200. The RSI is moving in overbought area, the Stochastic is moving in high ranges and the MACD indicator is in positive territory. The ADX is showing a weak buy signal. Buyers can wait for 1.0800 for their next target.

https://fxglory.com/eurusd-analysis-for-06-12-2016/

https://fxglory.com/eurusd-analysis-for-06-12-2016/

Monday, December 5, 2016

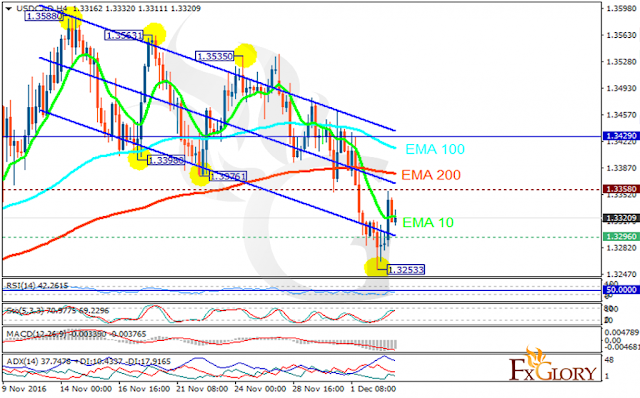

USDCAD analysis for 05.12.2016

While USDCAD is under the influence of oil price, USD lost power against its Canadian counterpart due to the US unemployment data. The pair is finding support at 1.32960 with resistance at 1.33580 which both lines are below the monthly pivot point at 1.34290. The EMA of 10 is moving with bearish bias and it is located below the EMA of 100 and above the EMA of 200. The RSI is moving below the 50 level, the MACD indicator is in negative territory and the Stochastic is moving horizontally in high ranges. The ADX is showing a weak sell signal. The support level breakthrough will be a good sign for sellers to target 1.3190 area.

https://fxglory.com/usdcad-analysis-for-05-12-2016/

https://fxglory.com/usdcad-analysis-for-05-12-2016/

USDJPY analysis for 05.12.2016

JPY is acting weak against USD. The support rests at 113.030 with resistance at 114.030 which both lines are above the monthly pivot point at 110.050. The EMA of 10 is moving horizontally but it is located above the EMA of 200 and the EMA of 100. The RSI is rising towards higher ranges, the Stochastic is showing upward momentum and the MACD indicator is in positive territory. The ADX is showing a weak sell signal. The resistance level breakout will push the pair to higher ranges targeting 115 area.

https://fxglory.com/usdjpy-analysis-for-05-12-2016/

https://fxglory.com/usdjpy-analysis-for-05-12-2016/

EURUSD analysis for 05.12.2016

Germany bonds market left a negative impact on EUR on Friday. The support rests at 1.05180 with resistance at 1.06050 which both lines are below the weekly pivot point at 1.06480. The EMA of 10 is moving with bearish bias along the descendant channel and it is below the EMA of 100 and the EMA of 200. The RSI is rising towards the 50 level, the Stochastic is moving in low ranges and the MACD indicator is in neutral territory. The ADX is not showing any clear signal. Long positions are recommended targeting 1.0689 area however, the support level breakthrough will smooth the way for further decline targeting 1.0461.

https://fxglory.com/eurusd-analysis-for-05-12-2016/

https://fxglory.com/eurusd-analysis-for-05-12-2016/

Friday, December 2, 2016

EURUSD analysis for 02.12.2016

While USD is being supported by the oil price EUR is being influenced by the PMIs in Germany and France disappointed markets. The support rests at 1.06560 with resistance at 1.07040 which both lines are above the weekly pivot point at 1.05870. The EMA of 10 is moving with bullish bias along the ascendant channel and it is below the EMA of 100. The RSI is falling towards the 50 level, the Stochastic is moving in high ranges and the MACD indicator is in positive territory. The ADX is showing buy signal. The support level breakthrough will smooth the way for further decline targeting 1.0550.

https://fxglory.com/eurusd-analysis-for-02-12-2016/

https://fxglory.com/eurusd-analysis-for-02-12-2016/

USDJPY analysis for 02.12.2016

As USD is getting strength due to the US economic reports, JPY is being empowered by the Japanese Manufacturing PMI. The support rests at 113.480 with resistance at 114.560 which the weekly pivot point at 112.440 is located in between the lines. The EMA of 10 is moving horizontally but it is located above the EMA of 200 and the EMA of 100. The RSI is falling towards the 50 level, the Stochastic is showing downward momentum and the MACD indicator is in positive territory. The ADX is not showing any clear signals. Long positions are recommended targeting 115.00 area.

https://fxglory.com/usdjpy-analysis-for-02-12-2016/

https://fxglory.com/usdjpy-analysis-for-02-12-2016/

Thursday, December 1, 2016

AUDUSD analysis for 01.12.2016

AUD is acting weak against its American counterpart due to the Building Permits release. The support rests in 0.73780 with resistance at 0.74360 which the weekly pivot point at 0.74030 is located in between the lines. The EMA of 10 is moving with bearish bias and it is located below the EMA of 100 and the EMA of 200. The RSI is moving below the 50 area, the MACD indicator is moving in neutral zone and the Stochastic is showing upward momentum. The ADX is not showing any clear signals. Short positions are recommended targeting 0.7350.

https://fxglory.com/audusd-analysis-for-01-12-2016/

https://fxglory.com/audusd-analysis-for-01-12-2016/

Subscribe to:

Posts (Atom)